EU Sustainable Taxonomy - What does it mean for the Real Estate Sector? Experts' opinion

On 21 April 2021, the European Commission released, its first and much debated EU Taxonomy Climate Delegated Act on Sustainable Finance initiative.

The EU Taxonomy is part of the EU’s overall efforts to reach the objectives of the European Green Deal and make Europe climate-neutral by 2050. Meant to set a robust, science-based transparency tool to help companies and investors make sustainable investment decisions, it is considered as the most significant development in sustainable finance, which, at EU level, aims at supporting the delivery on the objectives of the European Green Deal by channeling private investment into the transition to a climate neutral, climate-resilient, resource efficient and just economy, as a complement to public money. Thus, the Taxonomy mainly impacts investors and investments in financial products. Alongside a common classification system, the EU Taxonomy framework is designed to improve transparency. In other words, the Taxonomy is a toolkit for determining which economic activities are environmentally sustainable.

The Taxonomy Regulation, which entered into force in July 2020, requires the Commission to adopt Delegated Acts to establish technical screening criteria (TSC) for determining under which conditions a specific economic activity is considered to contribute to EU’s environmental objectives. The first Delegated Regulation on Sustainable Finance adopted last week sets an EU classification system for green investments, by defining the technical screening criteria for economic activities that can make a substantial contribution to climate change mitigation and climate change adaptation. These criteria create common ground for businesses and investors, allowing them to communicate about green activities credibly and help them to navigate the transition to sustainability. Those criteria cover the economic activities of roughly 40% of EU-domiciled listed companies in sectors which are responsible for almost 80% of direct greenhouse gas emissions in Europe. The companies (both financial and non-financial) that fall under the scope of the EU Taxonomy can use the criteria of the Taxonomy Climate Delegated Act as a compass to guide their transition towards sustainability. This Delegated Act will be formally adopted at the end of May and will enter into force at the end of the scrutiny period of co-legislators, and it will apply from 1 January 2022. A second Delegated Act for the remaining objectives will be published in 2022.

UIPI interviewed three experts on the topic. Here are their views:

Rikard, you closely followed the work on the Taxonomy both at EU and Swedish levels, why and how the Taxonomy is relevant for the real estate sector? Which part of the sector is primarily targeted?

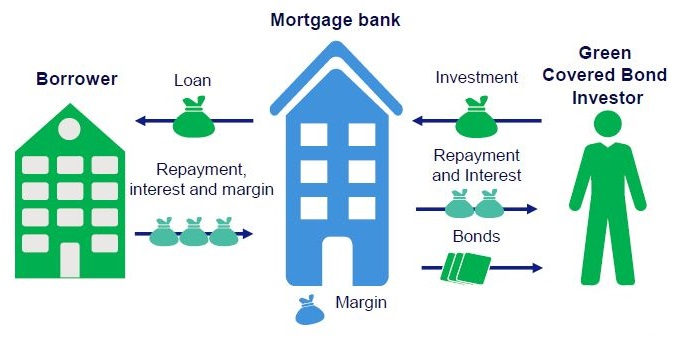

The Taxonomy can be described as a classification system for companies and investors to determine whether an economic activity is “environmentally sustainable”. The real estate sector is obviously not only closely linked to the finance sector and investors, it is also a vital part of the economy and it plays a key role in the transition towards more sustainability. Although, it does not affect individuals and their credit directly, the Taxonomy should also set a benchmark in the covered bond and green mortgage bond markets and ultimately affects the mortgage credit market. For our sector, construction of new buildings, renovation of existing buildings and acquisition and ownership of buildings are the most relevant economic activities classified in the Taxonomy.

What were the important aspects of the Delegated Act adopted this week and are you satisfied with the outcome?

A first draft of the Delegated Act published last November 2020 suggested that, for the “Acquisition and ownership of buildings”, only buildings with a Class A Energy Performance Certificate should be labelled environmentally sustainable, something that raised serious concerns both among the real estate and banking sectors. In our view, a reference only to Energy Performance Certificate (EPC) would have led to confusion for the financial sector when assessing economical activities in real estate as EPCs are defined, for the time being, differently across Member States, which will subsequently entail a lack of level-playing field and comparability in and outside the EU. The Swedish real estate sector, for example, is relatively energy performant compared to the EU average and yet only 1-2 percent of the stock reach class A, mainly because we have deliberately set strict requirements for our domestic energy classification. In addition, the grading system A-G has not even been introduced in all Member States in their EPC schemes and the reliability of the EPCs is still widely questioned in several countries, not a great sign for investors.

But these concerns have been tackled in the final EU text, based on our and many other stakeholders’ feedback, the European Commission decided to follow the original Technical Expert Group (TEG) on Sustainable Finance’s advice and considered not only A-rated properties to be sustainable, but also the properties that belong to the top 15% of the national or regional building stock expressed as operational Primary Energy Demand. A distinction is also made between residentials buildings and commercial properties in the classification.

What are the next steps?

The next step for the Delegated Act is to be approved by both the Council and the Parliament. There are still topics in the Delegated Act that are being heavily debated. Mostly related to energy production. This is also of interest to our sector as we are energy consumers but it doesn’t directly affect us. I would advise property companies not to wait in starting analysing their assets according to the Taxonomy. In addition, determining where the threshold for top 15% in operational Primary Energy Demand (PED) in each member state both for the residential and non-residential sector lies might require substantial work and investigation. National associations representing the real estate sector and property owners surely have a role to play in determining this threshold.

Jana, could you give us your view regarding the outcome of the Delegated Act? What are its strong points and what remains to be done?

We are very pleased to see the courage and ambition of the EU policy makers to drive ‘Sustainable Finance’ agenda forward. The EU Taxonomy is seen by the listed real estate sector as an important and much promising tool to help reorient capital flows towards long-term, environmentally sustainable economic activities. We are equally pleased that the Commission, based on the feedback, notably on the acquisition and ownership of buildings, decided to follow the original TEG’s advice and included the buildings within the top 15% in terms of energy performance on a national or regional scale.

On the other hand, we sense that there is more to do on ‘transitional finance’ for renovations. This will be a very important theme of the extension of the DA Taxonomy to capture the remaining four environmental objectives, including circular economy. Technical screening criteria for renovations are set well, with the focus on energy efficiency (PED). However, we invite the Commission to consider implications of the embodied carbon, life-cycle of buildings (life-carbon) approach and look again at how to finance transition from ‘brown’ to ‘improved’ assets.

Jennifer, could you tell us if the outcome of the published Delegated Act is satisfactory for the financial sector?

We also welcome the adoption of the European Commission’s Delegated Act on Taxonomy. It represents a significant step forward in the development of a new market paradigm which puts the financial services industry at the heart of efforts to scale up sustainable investment and implement the EU Green Deal, whilst fostering sustainable and digital innovation in the EU. We believe the European Commission has struck the right balance between sustainability ambitions and market best practices, whilst pursuing a Taxonomy implementation across the Single Market through a common language and clear definitions. In the context of the current pandemic, the EU Taxonomy will furthermore underpin efforts to ensure that the economic Recovery from the COVID-19 crisis is ‘green’.

How will the Taxonomy ultimately impact the mortgage market?

Our sector was equally particularly concerned about the EPC A requirement for existing buildings built before 31 December 2020 and the fact that this would significantly reduce (by up to 95%) eligible assets, with knock on effects for the entire value chain, from eligible mortgages to Taxonomy aligned green (covered) bonds. With these concerns in mind, we highlighted the importance of a more inclusive approach with a reference to EPC A and 15% best in class (in line with the TEG recommendations and existing market best practice) and put the spotlight on the Energy Efficient Mortgage Label – aimed at identifying energy efficient mortgages in lending institutions’ portfolios – as a robust way of stimulating consumer demand and supporting banks in aligning to the requirements over time, enabling them to demonstrate portfolio eligibility and deliver transparency and best practice at European and global level. We are therefore satisfied with the revised criteria which we believe will support the development of energy efficient mortgages and further expansion of the green (covered) bond market, and therefore enable the mortgage and covered bond industries to make their vital contributions to financing the climate transition and supporting a ‘green’ Recovery from the COVID-19 crisis.